City Financial Outlook

The city’s financial outlook is not as bleak as some would

have you believe, and to say the city has no plans to restore finances to

previous levels is simply an ignorant statement, by which I mean, the author of

that statement failed to do some basic research.

In 2013, the city

generated a $10 million surplus, and this year, the surplus is projected at

between $7.5 million and $10 million. It’s exactly for that reason that the

city was able to hold the tax increase for 2014 to a 0% increase, the first

time in at least 15 years. That required planning.

As at December 31,

2013, the city had nearly $130 million in cash or cash equivalents, comprised

of surplus/reserves ($94.1 M), DCC’s ($14 M), and deferred revenue ($21.1 M).

This information is readily accessible in the city’s audited annual financial

statements. Long-term debt existing from before 2006 has been repaid on an

accelerated basis due to the city’s strong cash position. That required

planning.

I’ve written about

the city’s debt in a previous article, but will repeat some of that here, to

give the reader a more complete picture of the city’s financial state of

health. The city has not been debt-free, at least as far back as 1997. In 2006,

the long-term debt stood at $38.4 million, down from $45 million in 2005.

Audited financial statements show that Abbotsford had $78.4 million in total

long-term debt at the end of 2013 (projected to be approximately $73.0 million

at the end of 2014). This long-term debt, which has a very favourable fixed

interest rate until maturity, is almost entirely related to the three Plan ‘A’

projects, which were approved by the citizens in a referendum.

In the last eight

years, the city has managed to complete significant infrastructure projects and

capital improvements totalling well in excess of $200 million, while long-term

debt increased by a net of only $40m million. That required planning. The list

includes: expansion to ARC, Discovery Trail, the Reach Gallery/Museum,

Abbotsford Centre, McCallum and Clearbrook interchanges (our portion was 1/3

cost on each), Airport improvements (1/3 cost), Whatcom Road Connector, new

Firehall, impoving and raising Dikes, new library, land acquired for Mill Lake

Park, upgrade of water mains, upgrade of James Treatment plant, drilling of

Bevan Wells (emergency supply when Norrish Creek water line became disabled in

2013), and upgrade of all-weather fields. This does not include all the annual

capital projects accounted for in departmental budgets, such as Engineering

annual $5 million Roads budget.

It must also be

noted that the two interchanges were completed well under projected budget

costs, allowing the city to construct the climbing lane on Highway #1, between

Sumas Way and McCallum Interchange, and to make the significant road

improvements to Marshall Rd. between Clearbrook and Mt. Lehman Roads, and

Clearbrook Rd. south of the interchange to King Rd. These capital projects

would normally have been entirely funded from city funds; however, in this case

the city’s cost was only one-third of the total cost. Moving forward, in the

short term, the city will need to focus on the replenishing of funds used from

DCC funds to complete the two interchanges.

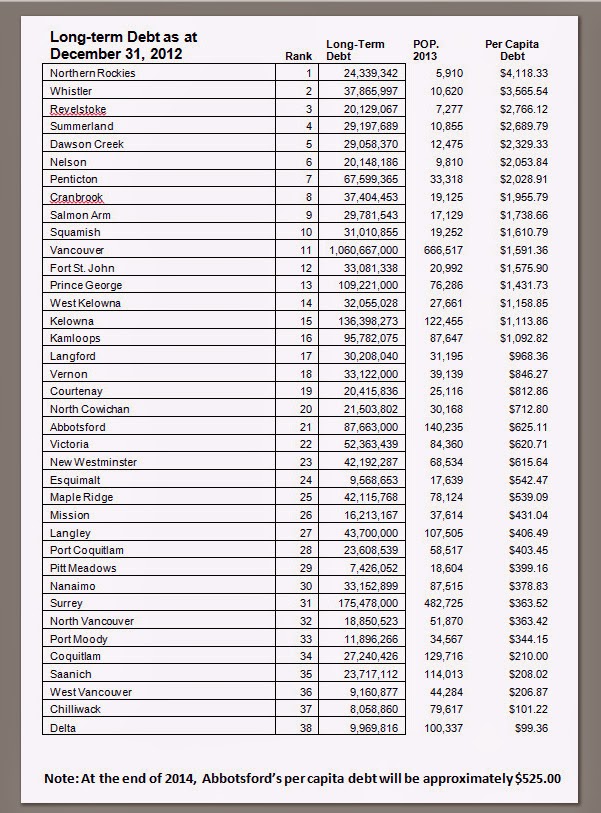

The above table is

based on the latest available data (2012) supplied by the Ministry of

Community, Sport, and Cultural Development. On a debt per capita basis,

Abbotsford is ranked 21st in the province. Based on the projected

long-term debt of $73 M. at the end of 2014, the figure will be approximately

$525/capita.

What needs to be noted with these figures,

with respect to metro municipalities, is that Metro Vancouver debt is not

factored in. In 2012, Metro Vancouver had a debt of $370 M., which is shared by

all its member municipalities, on a per capita basis. This debt relates to

their shared utilities: water, waste, housing, and corporate programs. This

would include 11 of the municipalities on the table that show lower per capita

debts than Abbotsford.

While my background

is not in the financial world, it is my humble opinion that the city’s

financial position is under very good control; infrastructure is in good shape;

and the city is poised to make continued progress in terms of strengthening our

financial health.