In Response to Questions from AbbotsfordFirst

Many of the questions asked require assistance from staff. That can be a time-consuming task, and if an opportunity presents itself, I can pursue those answers, Having said that, I think the point here is not an answer to every single question, but evidence that there is transparency and that nothing is being concealed. In fact, I suspect this exercise is a 'smoke screen' to deflect attention from more serious issues.

1. At the Plan A Referendum Public Information Session held in 2006

at the Matsqui Centennial Auditorium, Dan Bottrill, City Finance Manager,

stated that the City of Abbotsford was projecting a Property Tax Surplus of $4

million for 2007.

Answer: Really? 2006 – you want to address issues from 8 years

ago? Only 4 of the present Council members were on Council at the time. What I

don’t see here, which AbbotsfordFirst still claims on their website (Fred

Thiessen’s press release) even after being reminded on numerous occasions that

it is incorrect, is a statement that the City was debt-free in 2006. I

challenged each of the candidates as far back as August (excluding Sandy Blue),

as well as Fred Thiessen, to substantiate the claim, but no one responded to my

emails. In 2006, the City had a debt of $38.4m. The closest the City came to

being debt-free was 2004, when the long-term debt stood at $16m. This is but a

small example of knowingly misleading the public. Trust? Integrity?

1.

Debt levels at that time

are unknown to the public because Financial Statements prior to 2010 are

unavailable on the City web site. In fact, hardly any financial data allowing

us to compare our current financial state to that of the city before Plan A is

possible. If you have access to all those Statements, please allow the public

to have that same access so we can compare and decide for ourselves. We can

tell you that housing starts before 2009 averaged 1100 per year. After that it

has been abysmal... 2009 (365), 2010 (516), 2011 (537), 2012 (371), 2013 (749).

Comparing 2013, our best year in the last 5 to 2008, we see a 40% decrease in

housing starts. If you've managed our local economy so favourably, where has

all the investment gone? Account for this decrease in performance? (Source:

Canadian Mortgage and Housing Corp)

Answer: I‘ve seen stats posted by AbbotsfordFirst, referencing

Ministry sources – the same sources where you will find that information. However,

my Blog does have that information, taken from the Ministry site, and you are

welcome to save time and find it there.

And with respect to housing starts, I don’t believe I or anyone

else for that matter, have disputed any statements made on the subject. In

fact, I don’t recall seeing statements made anywhere else, other than in this

post. You are right, the world economy took a huge nose dive in 2008, and we

have not resumed the performance level in place prior to the downturn.

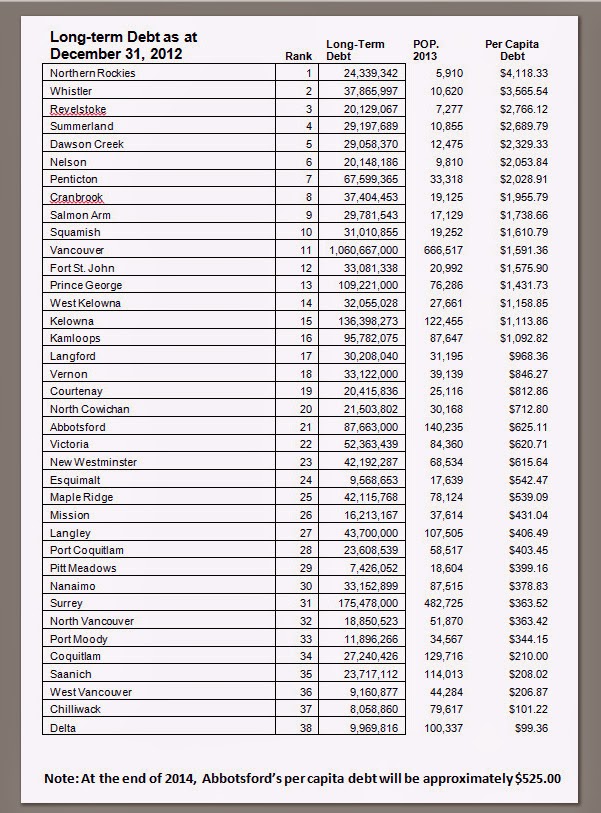

3. Total

debt - Firstly, we are unsure why you balk at $100 million in debt, but you

seem to think that $78.4 is OK. Please tell us why you think so. Secondly, you

are not including the $24 million internally borrowed (DCCs). Mr. Loewen claims

that money is moved back and forth between City accounts all the time. Setting

aside the fact that doing that anytime you want is against the Local Government

Act and the Community Charter, this debt is not the simple moving back and

forth of money. This money was largely spent on the 2 overpasses on Hwy 1 and

those overpasses were not in the city's budget. This means we have taken money

out of our DCC fund that should have been spent on other roads, infrastructure

upgrades and expansions. That other work still needs to be done. This is called

an infrastructure deficit. Every time you take future DCC money and use it to

pay for this expenditure of the past, you are not paying off debt, you are simply

paying off one credit card with another. At the end of the day, taxpayers will

be burdened with this rolling liability. How will you deal with this

infrastructure deficit of $24 million?

Answer:

1.

I’ve never said that any

debt is ‘OK’, as you put it. In fact, our long-term debt has been reduced by

25% over the last 6 years (a 25-year mortgage at a very favourable

fixed-interest rate until maturity). I should also add that the cost of

servicing our long-term debt (principal and interest) consumes less than 5% of

our annual operating budget. As a home owner, I would have loved a mortgage

that only required 5% of my income. Today, homeowners are lucky to stay below

30%.

2.

Drawing on Reserves is not considered

debt and financial statements make that clear. If you can’t accept that fact, I suggest you take your argument to KPMG or

our city manager, Mr. Murray, who I’m sure would be more than happy to provide

some enlightenment.

3.

My

response is clearly laid out in one of the posts deemed irrelevant. Your words,

“…none of your posts actually

answer any of the questions.” The post I’m referring to is “Take Your Choice”. http://councillorloewen.blogspot.ca/2014/11/take-your-choice.htmlhttp://councillorloewen.blogspot.ca/2014/11/take-your-choice.html

4.

Reserves are like Savings

Accounts, in which monies are set aside for a specific purpose. The Charter

does not forbid drawing on those Savings, but does say that those funds must be

restored to that account as soon as they are required for their intended use.

5.

To summarize very briefly

the post referenced in #1 above, the City leveraged Savings to get $50m. of “free”

money (never having to repay it), so that our infrastructure deficit, as you

refer to, might be addressed without burdening taxpayers. Your objection

appears to favour the latter option. I don’t know how else to interpret it.

NOTE: Since writing this article, I've been in conversation with Finance staff, and they provided what I believe is a very concise and definitive statement on this issue; City debt WAS $78m. at end of 2013. Their statement is found at the following link:

To the Source - Of Course!

6.

Additionally, the idea of paying off current DCC debt with

future DCC revenue has led Council to raising DCC's to the highest rate we can

find in the Valley. Our DCC rate is approximately $29,000 per lot, whereas

Langley is $21,000 and Burnaby is $7,000. The result has been a huge downturn

in housing starts. In 2008, we had 1285 starts. In 2012, we had 371 and 2013 we

had 749. In the 2013, the City projected $18 million in DCC revenue and it only

collected $3 million. How was that revenue made up? All departments set their

budgets against expected revenue so when $15 million doesn't come in, something

must be cut. What was cut?

Answer: Comparing Abbotsford’s DCC rates with

municipalities within Metro Vancouver is difficult. Metro Vancouver’s DCC

rates have not been updated for many years and they have made a decision to

fund significant regional infrastructure through user rates as opposed to DCC

rates. This means all existing taxpayers pay for growth related items as

opposed to new development. Abbotsford Council has taken the position

that growth should pay for expansion of new infrastructure.

With respect to specific rates, I am unable to provide an answer

as I’m not conversant in this matter, nor is that information easily available.

That doesn’t mean the information can’t be accessed, it’s just not at my

fingertips.

7.

You mention a strong cash position. Any excess cash coming to

the City of Abbotsford is due to "inflated" DCC's, an 80% + increase

in Water Rates from 2010 to 2012, a 43% Property Tax increase since 2006.

Taxing your citizens to pay for your mistakes is not strength. Can you clarify

for the citizens of Abbotsford why these rate increases are so high if your

stated surplus and financial position is so strong.

Answer: Of that 43% increase (assuming your figure is correct),

approximately 16% was the result of the Plan ‘A’ capital projects, which

residents of Abbotsford approved in a referendum. That would leave 27% over 8

years, which translates to approximately 3.5% per annum. Clearly, too high an

increase, as the last two years have been at or near zero. And for the record,

I don’t think I or anyone on this Council has stated that those increases were

acceptable. If you are going to revisit the last 10 years, I suggest you

revisit the last 20, starting with amalgamation. Councils of the first 10 years

were ultra-conservative, resulting in a significant infrastructure deficit that

could not be ignored. Even while the City was growing rapidly, Councils were

reluctant to spend in order to meet the challenge of a rapidly growing city.

There is also an implied comment in the question that Abbotsford property tax is excessively out of line with its neighbouring municipalities. In response, I would draw your attention to the two graphs in the following post:

http://councillorloewen.blogspot.ca/2014/10/property-taxes.html

8.

You mention the city has $130 million in cash or equivalents.

"Equivalents" is meaningless Mr. MacGregor...that is like saying I

have $100 in cash and coupons. What matters is the cash. In the 2013 Financial

Statement, on page 2, the page the Mayor signs, it clearly states on line 1

that "Cash and Cash Equivalents" equal $21 million. No line item

anywhere in the Financial Statement shows $130 million.

Answer: Surplus/Reserves - $94.1m.;

DCC’s - $14m.; and deferred revenue - $21.1m.

7. Last

year when the City of Abbotsford was thinking about giving the YMCA $17.5

million, the Finance Department issued a report to Council stating clearly that

they only had $14 million available, and then they offered alternatives on how

to make up the difference.

8. We

would like to point out that you cannot add our Statutory Reserve to this

amount because you are not allowed to spend that.

Answer: With respect, under the Charter, local governments can use those funds, but must restore within stipulated time frame; see #3 above.

9. On

that same page of the 2013 Financial Statement, there are also liabilities

listed. You cannot exclude those from your calculations. The NET FINANCIAL

ASSET for 2013 is $9 million...and this comes after 2012's $12 million NET

DEBT. This is not $130 million in the bank. This is the true financial picture

of the City of Abbotsford.

Answer: As you point out, the City had a Net Debt of $12.4m in 2012, followed by a Net Asset of $9.4m in 2013. That is a $21.8m turnaround, and projection for 2014 is similar to 2013. This is the result of two years under the management of a new CAO, who has executed Core Service Reviews in most, if not all departments and made significant changes in staffing structures and found efficiencies that had eluded previous administrations.

10.

Next you seemingly change the long term debt from $78.4 million to $40 million

so that you can claim we aren't being accurate? Please answer for this

inconsistency in your statement. No Financial Statement by the City of

Abbotsford, nor any statement by Abbotsford FIRST includes the number $40

million. Only you use this number and yet it is used to illustrate that in your

tenure you've doubled our long term debt. Explain why you would attempt to

represent a $78.4 million debt as $40 million to the citizens of Abbotsford?

Answer: The paragraph you refer to is a layman’s rough estimate

and interpretation of reality, with respect to the countless projects completed

in the last 8 years (roughly totally in excess of $200m.) against the real debt

at the end of those 8 years, leaving a net increase in debt of about $40m.

These are not accountants figures, nor would I expect Mr. Murray would ever

refer to that activity in these terms. If you choose to take issue with our

rough guesses, I for one will choose to ignore such concerns.

11. The

are also questions that you and all incumbent Councillors must answer Mr.

MacGregor. With one of the highest Property Tax rates in the Province of BC,

with the highest unemployment rate in Western Canada, with dwindling housing

starts and businesses closing every day, and a 9 year track record of nearly

every major economic indicator resulting in a decline, what are you going to do

to stimulate Abbotsford's economy? Please post your plans for the economic

development of Abbotsford. As an incumbent, you have far more access to

information and a comprehensive plan would be appreciated.

Answer: One of my Blog posts took issue with the erroneous use

of “Tax Rates” as a comparator.

http://councillorloewen.blogspot.ca/2014/10/assessed-value-taxrates-and-total-tax.html

I’ve responded to numerous people over

the years, and still, they/you don’t get it. This is not me saying this, but

Finance staff with whom I have consulted. A cursory review of a few BC

municipalities would make the point quite obvious to most people. There is a

common sense reason why the Provincial Government does not use ‘Rates’ to

compare one municipality with another. If rates were significant, then why

would West Vancouver and Whistler have the lowest tax rates in BC, while far

northern communities the highest? Are you suggesting that taxes in the far North

are that much higher than West Vancouver and Whistler?

I will however, humour you for the moment, and accept that our “high

tax rates” are a problem to address, and ask you to account for the discrepancy

between the high tax rates and the fact that Abbotsford’s property taxes

compare so favourably with the other Fraser Valley and Lower Mainland

municipalities, including West Vancouver (highest).

12. The

City of Abbotsford committed to giving the Abbotsford Heat $5.5 million to

leave our city. Where is that money coming from? What will be cut to provide

that capital? It wasn't in our budget so it is "new" money. Where

will you get it from?

Answer: My recollection is that the funds came from accumulated

surplus; I would have to check, because I am not certain. It should also be noted that the City's share of the revenue from Chances Gaming Centre (almost $1m annually) has been allocated to the AESC.

13.

If you're answer is from the Surplus you are generating from

"inflated" taxes and rates (language used by your own Finance

Department in 2013), the result has been a city with one of the lowest growth

rates in the Lower Mainland. How will you rectify this lack of performance and

attract business, investors and jobs?

Answer: First of all, it would be proper to reference your sources, especially comments regarding language used by Finance personnel). If you were listening to the mayoral debate this week,

you should have heard the Mayor reference a number of initiatives that will

have a positive influence in terms of addressing the concerns you mention:

DART, revised and consolidated Zoning Bylaw, and the OCP review now underway. George

Murray has been doing a Core Services Review over the last 2 years, resulting

in key hires, reorganization, and finding efficiencies that have resulted in observable

improvements with respect to “welcoming business”. These challenges do not

disappear in short time spans, but take longer for the change to become

apparent.

Those reviews have also resulted in two successive years with

modest surpluses of $10m. last year, and $7 - $10m this year. Those funds have

and will continue to be applied to DCC funds and/or short-term debt.

I have not responded to every single question, however, I

think most of them have been covered. More detail on questions regarding DCC

rates, etc, are all available, however, it will take some digging, as I have

done.